|

GODINA/ YEAR: L. ZAGREB,

27. RUJNA 2013./ 27 SEPTEMBER, 2013 BROJ/

NUMBER: 6.1.5.

POREZI I NAKNADE ZA

OKOLIŠ, 2004. – 2011.

ENVIRONMENTAL TAXES AND CHARGES, 2004

– 2011

|

U

procesu prilagodbe statistici Europske unije u sklopu Višekorisničkog

programa PHARE 2006. Državni zavod za statistiku je prvi put proveo

istraživanje o ekološkim porezima i naknadama.

|

|

In the

process of harmonisation with the European Union and within the 2006

Multi-beneficiary PHARE Programme, the Croatian Bureau of Statistics has

for the first time carried out the survey on environmental taxes and

charges.

|

|

|

|

|

|

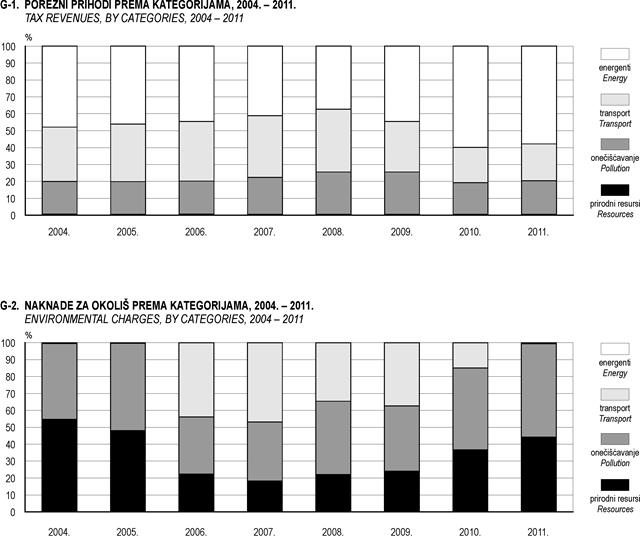

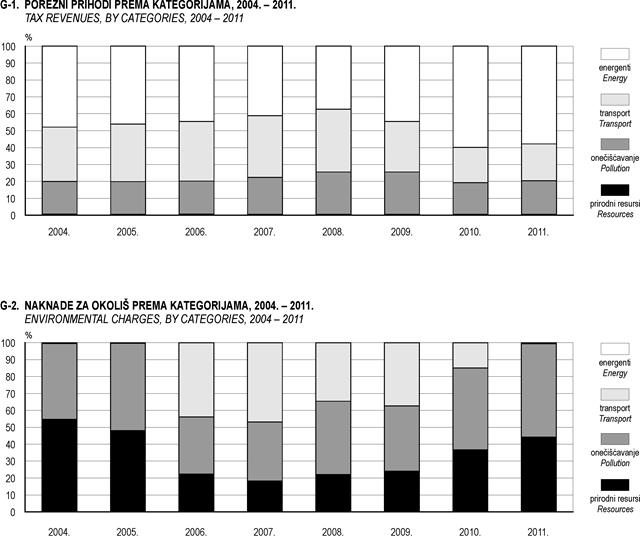

U ovom

priopćenju prikazana je serija podataka za četiri glavne kategorije

poreznih prihoda i naknada za okoliš za Republiku Hrvatsku od 2004. do

2011.

|

|

This

release presents a data series for four main categories of environmental

taxes and charges for the Republic of Croatia in the period from 2004 to

2011.

|

1. POREZNI PRIHODI ZA OKOLIŠ I NAKNADE ZA

OKOLIŠ PREMA KATEGORIJAMA

ENVIRONMENTAL TAX REVENUES AND

ENVIRONMENTAL CHARGES, BY CATEGORIES

kune/ Kuna

|

|

Porezni

prihodi i naknade za okoliš prema kategorijama za

Environmental tax revenues and environmental charges, by categories, for

|

|

energente

Energy

|

transport

Transport

|

onečišćavanje

Pollution

|

prirodne

resurse

Resources

|

|

|

|

|

|

|

|

2004.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

3

323 408 546

|

2

232 743 807

|

1

341 351 715

|

44

557 460

|

|

Naknade za

okoliš

Environmental charges

|

113

914

|

9

658 179

|

993

845 755

|

1

207 909 910

|

|

|

|

|

|

|

|

2005.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

3

331 955 997

|

2

455 704 813

|

1

392 405 307

|

44

603 511

|

|

Naknade za

okoliš

Environmental charges

|

188

402

|

7

282 217

|

1

410 681 291

|

1

307 914 628

|

|

|

|

|

|

|

|

2006.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

3

449 275 405

|

2

724 407 748

|

1

512 197 663

|

50

253 645

|

|

Naknade za

okoliš

Environmental charges

|

127

117

|

2

908 922 900

|

2

233 986 556

|

1

485 818 519

|

|

|

|

|

|

|

|

2007.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

3

389 532 153

|

2

999 115 651

|

1

801 332 035

|

42

486 983

|

|

Naknade za

okoliš

Environmental charges

|

538

951

|

4

573 734 632

|

3

416 511 561

|

1

781 051 066

|

|

|

|

|

|

|

|

2008.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

3

109 152 134

|

3

091 278 698

|

2

087 578 244

|

41

320 391

|

|

Naknade za

okoliš

Environmental charges

|

768

646

|

2

951 799 562

|

3

693 899 367

|

1

884 404 850

|

|

|

|

|

|

|

|

2009.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

3

426 502 133

|

2

300 742 775

|

1

924 186 650

|

45

730 576

|

|

Naknade za

okoliš

Environmental charges

|

990

646

|

2

822 283 571

|

2

921 976 947

|

1

826 415 453

|

|

|

|

|

|

|

|

2010.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

6

476 713 917

|

2

250 229 155

|

2

035 215 887

|

50

871 966

|

|

Naknade za

okoliš

Environmental charges

|

844

872

|

758

829 947

|

2

471 126 504

|

1

867 351 007

|

|

|

|

|

|

|

|

2011.

|

|

|

|

|

|

Porezni

prihodi za okoliš

Environmental tax revenues

|

6

034 251 839

|

2

274 709 227

|

2

078 776 757

|

50

445 420

|

|

Naknade za

okoliš

Environmental charges

|

1

399 118

|

25

336 289

|

2

266 928 450

|

1

810 827 031

|

|

METODOLOŠKA OBJAŠNJENJA

|

|

NOTES ON METHODOLOGY

|

|

|

|

|

|

|

|

|

|

Izvor i

metode prikupljanja podataka

|

|

Source

and methods of data collection

|

|

|

|

|

|

Ovo

priopćenje sastavlja se na temelju Izvještaja o vlastitim prihodima i

primicima državnog, županijskih i gradskih/ općinskih proračuna (P-1) i

Izvještaja o uplati i rasporedu zajedničkih prihoda proračuna, određenih

ustanova i trgovačkih društava u vlasništvu Republike Hrvatske te prihoda

za druge javne potrebe (P-2) Fine, i podataka Fonda za zaštitu okoliša i

energetsku učinkovitost.

|

|

This

release is prepared on the basis of the Fina’s Report on Own Income and

Revenues in the Government, County and Town/Municipal Budgets (P-1 form)

and the Report on Payments and Arrangement of Joint Budget Incomes,

Particular Institutions and Trade Companies Owned by the Republic of

Croatia and Incomes for Other Public Needs (P-2 form) as well as on data of

the Environment Protection and Energy Efficiency Fund.

|

|

|

|

|

|

|

|

|

|

Definicije

|

|

Definitions

|

|

|

|

|

|

Ekološki

porezi jesu

porezi

čija je porezna osnovica fizička jedinica (ili njezina zamjena) nečega što

ima dokazan, specifičan negativan učinak na okoliš.

|

|

Environmental

tax is a tax with a physical unit (or its proxy of it)

as a base of something that has a proven, specific negative impact on the

environment.

|

|

|

|

|

|

Ekološke

naknade

isto su što i pristojbe.

|

|

Environmental

charges means the same as

fees.

|

|

|

|

|

|

Porezni

prihod

jest prihod prikupljen od poreza.

|

|

Tax

revenue means the revenue collected on the tax.

|

|

|

|

|

|

Pristojbe OECD

definira pristojbe kao obvezatna, neuzvraćena plaćanja općoj državi ili

tijelima izvan opće države, kao što su npr. fondovi za zaštitu okoliša ili

vodoprivreda. Pristojbe se smatraju plaćanjem za usluge.

|

|

Charges, as

the OECD defines them, mean compulsory, requited payments to either general

government or to bodies outside general government, such as for instance an

environmental fund or a water management board. Charges are seen as

payments for services.

|

|

|

|

|

Porezi

na energente skupina je koja uključuje poreze na energetske

proizvode koji se koriste za transport i za stacionarne svrhe. Najvažniji

energetski proizvodi za transport jesu benzin i dizel. Energetski proizvodi

za stacionarnu uporabu uključuju loživa ulja, prirodni plin, ugljen i

električnu energiju. Porezi na CO2 uključeni su u poreze na

energente, a ne u poreze na zagađivanje. Za to postoji nekoliko razloga.

Prije svega, često nije moguće identificirati poreze na CO2

odvojeno u statistici poreza zato što su integrirani s porezima na

energente, npr. preko diferencijacije poreznih stopa za mineralna ulja.

Osim toga, djelomično su uvedeni kao zamjena za druge poreze na energente,

a prihod od tih poreza često je velik u usporedbi s prihodima od poreza na

zagađivanje. To znači da bi uključivanje poreza na CO2 u poreze

na zagađivanje umjesto u poreze na energente iskrivilo međunarodne

usporedbe. Ako se mogu identificirati, porezi na CO2 trebali bi

biti prijavljeni kao posebna kategorija uz porez na energente. Kod poreza

na CO2 može postojati isti problem kao i kod poreza na CO2.

|

|

Energy

taxes include taxes on energy products used for both

transport and stationary purposes. The most important energy products for

transport purposes are petrol and diesel. Energy products for stationary

use include fuel oils, natural gas, coal and electricity. The CO2 taxes

included under energy taxes rather than under pollution taxes. There are

several reasons for this. First of all, it is often not possible to

identify CO2 axes separately in tax statistics, because they are

integrated with energy taxes, e.g. via differentiation of mineral oil tax

rates. In addition, they are partly introduced as a substitute for other

energy taxes and the revenue from these taxes is often large compared to

the revenue from the pollution taxes. This means that including CO2

taxes with pollution taxes rather than energy taxes would distort

international comparisons. If they are identifiable, CO2 taxes

should be reported as a separate category next to energy taxes. CO2

taxes may be subject to the same problem as CO2 taxes.

|

|

|

|

|

|

Porezi

na transport skupina je koja uključuje poreze povezane s

vlasništvom nad motornim vozilima i njihovom uporabom. Porezi na drugu

prijevoznu opremu (npr. avione) i povezane prijevozne usluge (npr. porez na

čarter-letove ili redovite letove) također su ovdje uključeni, kada

odgovaraju općoj definiciji ekoloških poreza. Porezi na transport također

mogu biti "jednokratni" porezi povezani s uvozom ili prodajom

opreme ili stalni porezi kao što je godišnji porez za ceste. Porezi na

benzin, dizel i druga goriva za transport uključeni su u poreze na

energente.

|

|

Transport

taxes include taxes related to the ownership and use of

motor vehicles. Tax on other transport equipment (e.g. planes), and related

transport services (e.g. duty on charter or scheduled flights) are also

included here, when they conform to the general definition of environmental

taxes. The transport taxes may be ”one-off” taxes related to imports or

sales of the equipment or recurrent taxes such as an annual road tax. Taxes

on petrol, diesel and other transport fuels are included under energy

taxes.

|

|

|

|

|

|

Porezi

na onečišćavanje skupina je koja uključuje poreze na

izmjerena ili procijenjena ispuštanja u zrak i vodu, gospodarenje krutim

otpadom i buku. Iznimka su porezi na CO2, koji su uključeni pod

poreze na energente kako je prethodno navedeno.

|

|

Pollution

taxes include taxes on measured or estimated emission to

air and water, management of solid waste and noise. An exception is the CO2

taxes, which are included under energy taxes as discussed above.

|

|

|

|

|

|

Porezi

na prirodne resurse predstavljaju određene probleme. Postoje

razlike u mišljenjima oko pitanja je li vađenje prirodnih resursa štetno za

okoliš samo po sebi, premda se mnogi slažu u tome da može dovesti do

ekoloških problema, kao što su onečišćenje i erozija tla.

|

|

Taxes

on resources pose some particular problems. There are

differences in opinion on whether resource extraction is environmentally

harmful in itself, although there is a broad agreement that it can lead to

environmental problems, such as pollution and soil erosion.

|

|

|

|

|

|

|

|

|

|

Kratice

|

|

Abbreviations

|

|

|

|

|

|

|

CO2

|

ugljikov

dioksid

|

|

FINA

|

Financial

Agency

|

|

Fina

npr.

OECD

SO2

|

Financijska

agencija

na

primjer

Organizacija

za ekonomsku suradnju i razvoj

sumporov

dioksid

|

|

OECD

CO2

SO2

|

Organization for

Economic Cooperation and Development

carbon dioxide

sulphur

dioxide

|

|

|

|

|

|

|

|

|

|

Ovaj

dokument proizveden je uz financijsku pomoć Europske unije. Za sadržaj

dokumenta odgovoran je isključivo Državni zavod za statistiku te se ni pod kojim

uvjetima ne smije smatrati da izražava stav Europske unije.

|

|

This document has been produced with the financial

assistance of the European Union. The contents of this document are the

sole responsibility of the Croatian Bureau of Statistics and can under no

circumstances be regarded as reflecting the position of the European Union.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Izdaje i

tiska Državni zavod za statistiku Republike Hrvatske, Zagreb, Ilica 3, p. p.

80.

Published and printed by the Croatian Bureau of Statistics, Zagreb,

Ilica 3, P. O. B. 80

Telefon/ Phone:

+385 (0) 1 4806-111, telefaks/ Fax: +385 (0) 1 4817-666

Odgovara

ravnatelj Marko Krištof.

Person responsible: Marko Krištof, Director

General

Priredila:

Vesna Koletić

Prepared

by: Vesna Koletić

|

|

MOLIMO KORISNIKE DA

PRI KORIŠTENJU PODATAKA NAVEDU IZVOR.

USERS

ARE KINDLY REQUESTED TO STATE THE SOURCE.

|

|

Naklada:

20 primjeraka

20 copies

printed

Podaci iz

ovog priopćenja objavljuju se i na internetu.

First Release data are also published on the

Internet.

|