|

|

GODINA/ YEAR: LVII.

|

ZAGREB,

25. RUJNA 2020./ 25 SEPTEMBER, 2020

|

BROJ/ NUMBER:

6.1.6.

|

CODEN POPCEA ISSN 1330-0350

POREZI I NAKNADE ZA OKOLIŠ U 2018.

ENVIRONMENTAL TAXES

AND CHARGES, 2018

|

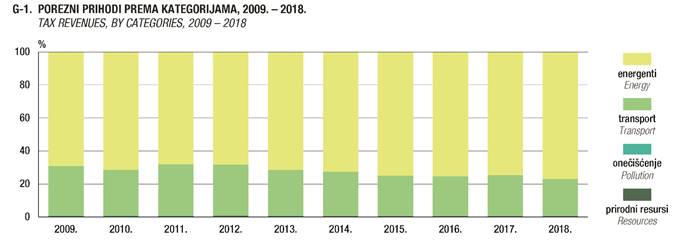

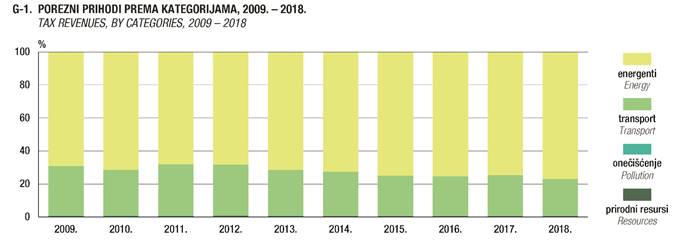

Prikazana

je serija podataka za četiri glavne kategorije poreznih prihoda i naknada

za okoliš za Republiku Hrvatsku od 2009. do 2018. Porezni prihodi od

energetskih poreza u 2018. viši su za 9,8% u odnosu na 2017. te za 62,9% u

odnosu na 2009. Prihodi od poreza vezanih za transport u 2018. manji su za

4,1% u usporedbi s 2017., a za 9,1% viši u odnosu na 2009. U odnosu na

2017. porezni prihodi vezani za onečišćivanje u 2018. viši su za 134,5%, a

u odnosu na 2009. niži za 79,4%. Porezni prihodi vezani za poreze za

prirodne resurse u 2018. viši su za 30,2% u odnosu na 2017., a za 52,4%

viši u odnosu na 2009.

|

|

Data series for the four main categories of the environmental

tax revenues and environmental charges are presented for the Republic of

Croatia in the period from 2009 to 2018. Tax revenues from energy taxes in

2018 increased by 9.8% compared to 2017 and by 62.9% compared to 2009. Tax

revenues from transport taxes in 2018 decreased by 4.1% compared to 2017,

while they increased by 9.1% compared to 2009. Tax revenues from pollution

taxes in 2018 increased by 134.5% compared to 2017, while they decreased by

79.4% compared to 2009. Tax revenues from taxes on resources in 2018

increased by 30.2% compared to 2017 and by 52.4% compared to 2009.

|

1. POREZNI

PRIHODI ZA OKOLIŠ I NAKNADE ZA OKOLIŠ PREMA KATEGORIJAMA1)

ENVIRONMENTAL

TAX REVENUES AND ENVIRONMENTAL CHARGES, BY CATEGORIES1)

kune

Kuna

|

|

Porezni prihodi i naknade za okoliš prema

kategorijama za

Environmental tax revenues and environmental

charges, by categories, for

|

|

|

|

energente

Energy

|

transport

Transport

|

onečišćenje

Pollution

|

prirodne resurse

Resources

|

|

|

|

|

|

|

|

|

|

2009.

|

|

|

|

|

2009

|

|

Porezni

prihodi za okoliš

|

6

501 418 596

|

2

827 968 888

|

24

152 901

|

46

520 507

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

990

646

|

2

822 283 571

|

2

921 976 947

|

1

826 415 453

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2010.

|

|

|

|

|

2010

|

|

Porezni

prihodi za okoliš

|

7

146 340 549

|

2

767 414 799

|

19

351 865

|

53

893 812

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

844

872

|

758

829 947

|

2

471 126 504

|

1

867 351 007

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2011.

|

|

|

|

|

2011

|

|

Porezni

prihodi za okoliš

|

6

081 451 889

|

2

788 775 768

|

12

191 521

|

49

360 994

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

1

399 118

|

25

336 289

|

2

266 928 450

|

1

810 827 031

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2012.

|

|

|

|

|

2012

|

|

Porezni

prihodi za okoliš

|

5

778 957 880

|

2

625 465 595

|

8

918 782

|

50

656 018

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

3

523 202

|

23

017 776

|

1

821 941 132

|

1

565 971 995

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2013.

|

|

|

|

|

2013

|

|

Porezni

prihodi za okoliš

|

6

783 646 257

|

2

635 081 972

|

6

381 677

|

51

029 940

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

3

219 937

|

18

392 924

|

1

912 731 393

|

1

809 839 489

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2014.

|

|

|

|

|

2014

|

|

Porezni

prihodi za okoliš

|

7

663 595 689

|

2

817 000 525

|

3

174 551

|

53

943 546

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

1

645 682

|

25

484 082

|

2

052 617 384

|

2

068 366 598

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2015.

|

|

|

|

|

2015

|

|

Porezni

prihodi za okoliš

|

8

574 921 361

|

2

817 048 576

|

2

211 231

|

52

270 300

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

1

089 845

|

27

941 597

|

2

301 992 367

|

2

129 907 606

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2016.

|

|

|

|

|

2016

|

|

Porezni

prihodi za okoliš

|

9

239 314 207

|

2

949 739 372

|

6

563 422

|

53

201 067

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

812

519

|

20

499 688

|

2

324 491 173

|

2

143 440 866

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2017.

|

|

|

|

|

2017

|

|

Porezni

prihodi za okoliš

|

9

640 876 930

|

3

216 904 890

|

2

126 467

|

54

442 870

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

755

234

|

44

953 405

|

2

362 519 062

|

2

099 760 862

|

Environmental

charges

|

|

|

|

|

|

|

|

|

2018.

|

|

|

|

|

2018

|

|

Porezni

prihodi za okoliš

|

10

588 529 224

|

3

084 118 600

|

4

986 599

|

70

897 997

|

Environmental

tax revenues

|

|

Naknade za

okoliš

|

705

252

|

32

789 374

|

2

406 105 996

|

2

181 163 989

|

Environmental

charges

|

1) Podaci su revidirani i nisu

usporedivi s prethodnim godinama.

1) Data

were revised and are not comparable to the data from previous years.

|

METODOLOŠKA

OBJAŠNJENJA

|

|

NOTES

ON METHODOLOGY

|

|

|

|

|

|

|

|

|

|

Izvor

i metode prikupljanja podataka

|

|

Source

and methods of data collection

|

|

|

|

|

|

Ovo

Priopćenje sastavlja se na temelju Izvještaja o vlastitim prihodima i

primicima državnoga, županijskih i gradskih/općinskih proračuna (P-1) i

Izvještaja o uplati i rasporedu zajedničkih prihoda proračuna, određenih

ustanova i trgovačkih društava u vlasništvu Republike Hrvatske te prihoda

za druge javne potrebe (P-2 i P-3) Financijske agencije i podataka Fonda za

zaštitu okoliša i energetsku učinkovitost.

|

|

This

First Release is prepared on the basis of the Report on Own Income and

Revenues in the Government, County and Town/Municipal Budgets (P-1 form)

and the Report on Payments and Arrangement of Joint Budget Incomes,

Particular Institutions and Trade Companies Owned by the Republic of

Croatia and Incomes for Other Public Needs (P-2 and P-3 form) of the

Financial Agency, as well as on the data of the Environment Protection and

Energy Efficiency Fund.

|

|

|

|

|

|

|

|

|

|

Definicije

|

|

Definitions

|

|

|

|

|

|

Ekološki

porezi jesu

porezi

čija je porezna osnovica fizička jedinica (ili njezina zamjena) nečega što

ima dokazan, specifičan negativan učinak na okoliš.

|

|

Environmental

tax is a tax with a physical unit (or its proxy) as a

base of something that has a proven, specific negative impact on the

environment.

|

|

|

|

|

|

Ekološke

naknade

isto su što i pristojbe, a definiraju se kao obvezatna, neuzvraćena

plaćanja općoj državi ili tijelima izvan opće države kao što su fondovi za

zaštitu okoliša ili vodoprivreda. Pristojbe se smatraju plaćanjem za

usluge.

|

|

Environmental

charges are the same as

fees and are defined as compulsory, non-refundable payments to the

general government or to bodies outside the general government such as

environment protection funds or water management. Payments for services are

considered to be fees.

|

|

|

|

|

|

Porezni

prihod

za okoliš jest prihod prikupljen od poreza unutar pojedine okolišne

kategorije (porezi na energente, porezi na transport, porezi na onečišćenja

i porezi na prirodne resurse).

|

|

Environmental

tax revenue means the revenue collected from taxes within particular

environmental categories (energy taxes, transport taxes, pollution taxes

and taxes on resources).

|

|

|

|

|

|

Porezi

na energente skupina je koja uključuje poreze na energetske

proizvode koji se koriste za transport i za stacionarne svrhe. Najvažniji

energetski proizvodi za transport jesu benzin i dizel. Energetski proizvodi

za stacionarnu uporabu uključuju loživa ulja, prirodni plin, ugljen i

električnu energiju. Porezi na CO2 uključeni su u poreze na

energente, a ne u poreze na zagađivanje. Za to postoji nekoliko razloga.

Prije svega, često nije moguće identificirati poreze na CO2

odvojeno u statistici poreza zato što su integrirani s porezima na

energente, npr. preko diferencijacije poreznih stopa za mineralna ulja.

Osim toga, djelomično su uvedeni kao zamjena za druge poreze na energente,

a prihod od tih poreza često je velik u usporedbi s prihodima od poreza na

zagađivanje. To znači da bi uključivanje poreza na CO2 u poreze

na zagađivanje umjesto u poreze na energente iskrivilo međunarodne

usporedbe. Ako se mogu identificirati, porezi na CO2 trebali bi

biti prijavljeni kao posebna kategorija uz porez na energente. Kod poreza

na SO2 može postojati isti problem kao i kod poreza na CO2.

|

|

Energy

taxes include taxes on energy products used for both

transport and stationary purposes. The most important energy products for

transport purposes are petrol and diesel. Energy products for stationary

use include fuel oils, natural gas, coal and electricity. The CO2

taxes are included under energy taxes rather than under pollution taxes.

There are several reasons for this. First of all, it is often not possible

to identify CO2 taxes separately in tax statistics, because they

are integrated with energy taxes, e.g. via differentiation of mineral oil

tax rates. In addition, they are partly introduced as a substitute for

other energy taxes and the revenue from these taxes is often large compared

to the revenue from pollution taxes. This means that including CO2

taxes in pollution taxes rather than in energy taxes would distort

international comparisons. If they are identifiable, CO2 taxes

should be reported as a separate category next to energy taxes. SO2

taxes may be subject to the same problem as CO2 taxes.

|

|

|

|

|

|

Porezi

na transport skupina je koja uključuje poreze povezane s

vlasništvom nad motornim vozilima i njihovom upotrebom. Porezi na drugu

prijevoznu opremu (npr. avione) i povezane prijevozne usluge (npr. porez na

čarter-letove ili redovite letove) također su ovdje uključeni, kada

odgovaraju općoj definiciji ekoloških poreza. Porezi na transport također

mogu biti "jednokratni" porezi povezani s uvozom ili prodajom opreme

ili stalni porezi kao što je godišnji porez za ceste. Porezi na benzin,

dizel i druga goriva za transport uključeni su u poreze na energente.

|

|

Transport

taxes include taxes related to the ownership and use of

motor vehicles. Tax on other transport equipment (e.g. planes), and related

transport services (e.g. duty on charter or scheduled flights) are also

included here if they conform to the general definition of environmental

taxes. The transport taxes may be "one-off"

taxes related to imports or sales of the equipment or recurrent taxes such

as an annual road tax. Taxes on petrol, diesel and other transport fuels

are included in energy taxes.

|

|

|

|

|

|

Porezi

na onečišćenja skupina je koja uključuje poreze na

izmjerena ili procijenjena ispuštanja u zrak i vodu, gospodarenje krutim

otpadom i buku. Iznimka su porezi na CO2, koji su uključeni pod

poreze na energente, kako je prethodno navedeno.

|

|

Pollution

taxes include taxes on measured or estimated emission to

air and water, management of solid waste and noise. CO2 taxes

are an exception, since they are included in energy taxes as discussed

above.

|

|

|

|

|

|

Porezi

na prirodne resurse skupina je koja uključuje poreze koji se

odnose na vađenje ili korištenje prirodnih resursa poput vode, šuma, divlje

flore i faune. Te aktivnosti iscrpljuju prirodne resurse.

|

|

Taxes

on resources include taxes linked to the extraction or

to the use of natural resources, such as water, forests, wild flora and

fauna. These activities deplete natural resources.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kratice

|

|

Abbreviations

|

|

|

|

|

|

CO2

|

ugljikov

dioksid

|

|

CO2

|

carbon

dioxide

|

|

ESA

2010

|

Europski

sustav nacionalnih računa, verzija 2010.

|

|

ESA

2010

|

European System of Accounts, 2010 version

|

|

SO2

|

sumporov

dioksid

|

|

SO2

|

sulphur

dioxide

|

Objavljuje Državni zavod za

statistiku Republike Hrvatske, Zagreb, Ilica 3, p. p. 80.

Published by the Croatian Bureau of

Statistics, Zagreb, Ilica 3, P. O. B. 80

Telefon/ Phone: +385

(0) 1 4806-111, telefaks/ Fax: +385 (0) 1 4817-666

Novinarski upiti/ Press

corner: press@dzs.hr

Odgovorne osobe:

Persons responsible:

Edita Omerzo, načelnica Sektora

prostornih statistika

Edita Omerzo, Director of Spatial

Statistics Directorate

Lidija Brković, glavna ravnateljica

Lidija Brković, Director General

Priredili: Darko Jukić, Gordana

Lepčević, Željka Čuklić i Bernarda Šimunić

Prepared by: Darko Jukić, Gordana

Lepčević, Željka Čuklić and Bernarda Šimunić

|

|

MOLIMO

KORISNIKE DA PRI KORIŠTENJU PODATAKA NAVEDU IZVOR.

USERS ARE KINDLY

REQUESTED TO STATE THE SOURCE.

|

|

Služba za odnose s korisnicima i

zaštitu podataka

Customer Relations and Data

Protection Department

|

Informacije i korisnički zahtjevi

Information and user requests

|

|

Pretplata publikacija

Subscription

|

|

|

|

|

|

Telefon/ Phone: +385 (0) 1 4806-138, 4806-154

Elektronička pošta/ E-mail: stat.info@dzs.hr

Telefaks/ Fax: +385 (0) 1 4806-148

|

|

Telefon/ Phone: +385 (0) 1 4806-115

Elektronička pošta/ E-mail: prodaja@dzs.hr

Telefaks/ Fax: +385 (0) 1 4806-148

|

|