|

|

GODINA/ YEAR:

LVIII.

|

ZAGREB,

20.

PROSINCA 2021./ 20 DECEMBER, 2021

|

BROJ/ NUMBER: 9.1.1/10.

|

CODEN POPCEA ISSN 1330-0350

PROSJEČNE MJESEČNE NETO I BRUTO

PLAĆE ZAPOSLENIH

za listopad 2021.

AVERAGE MONTHLY NET AND GROSS

EARNINGS OF PERSONS IN PAID EMPLOYMENT

For

October 2021

|

Prosječna

mjesečna isplaćena neto plaća po zaposlenome u pravnim osobama Republike

Hrvatske za listopad 2021. iznosila je 7 140 kuna, što je nominalno

više za 0,5%, a realno niže za 0,5% u odnosu na rujan 2021.

|

|

For

October 2021, the average monthly paid off net earnings per person in paid

employment in legal entities in the Republic of Croatia amounted to 7 140

kuna, which represented a nominal increase of 0.5% and a real decrease of

0.5%, as compared to September 2021.

|

|

|

|

|

|

Prosječna

mjesečna bruto plaća po zaposlenome u pravnim osobama Republike Hrvatske za

listopad 2021. iznosila je 9 597 kuna, što je nominalno više za 0,5%,

a realno niže za 0,5% u odnosu na rujan 2021.

|

|

For

October 2021, the average monthly gross earnings per person in paid

employment in legal entities in the Republic of Croatia amounted to 9 597

kuna, which represented a nominal increase of 0.5% and a real decrease of

0.5%, as compared to September 2021.

|

|

|

|

|

|

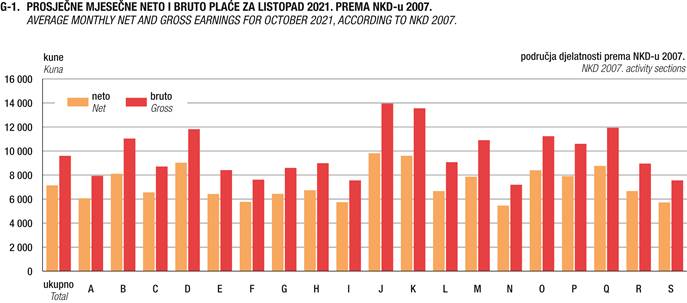

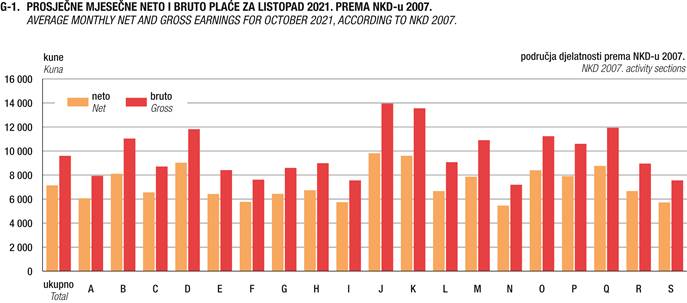

Najviša

prosječna mjesečna isplaćena neto plaća po zaposlenome u pravnim osobama za

listopad 2021. isplaćena je u djelatnosti Proizvodnja koksa i rafiniranih

naftnih proizvoda, u iznosu od

10 928 kuna, a najniža je isplaćena u djelatnosti Proizvodnja odjeće, u

iznosu od 4 533 kune.

|

|

The

highest average monthly paid off net earnings per person in paid employment

in legal entities for October 2021 were paid off in the activity

Manufacture of coke and refined petroleum products and amounted to 10 928

kuna, while the lowest earnings were paid off in the activity Manufacture

of wearing apparel and amounted to 4 533 kuna.

|

|

|

|

|

|

Najviša

prosječna mjesečna bruto plaća po zaposlenome u pravnim osobama za listopad

2021. bila je u djelatnosti Proizvodnja koksa i rafiniranih naftnih

proizvoda, u iznosu od 15 910 kuna, a najniža je bila u djelatnosti

Proizvodnja odjeće, u iznosu od 5 769 kuna.

|

|

The

highest average monthly gross earnings per person in paid employment in

legal entities for October 2021 were recorded in the activity Manufacture

of coke and refined petroleum products and amounted to 15 910 kuna, while

the lowest earnings were recorded in the activity Manufacture of wearing

apparel and amounted to 5 769 kuna.

|

|

|

|

|

|

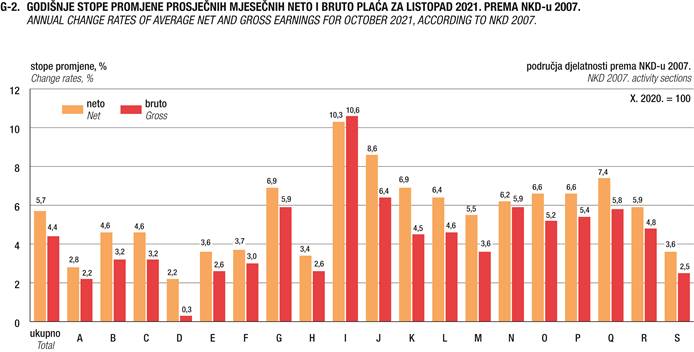

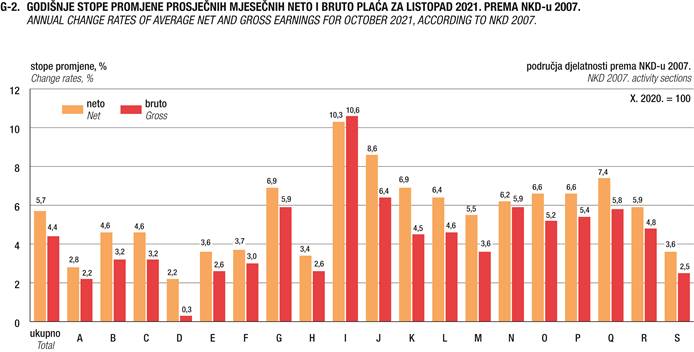

Prosječna

mjesečna isplaćena neto plaća po zaposlenome u pravnim osobama Republike

Hrvatske za listopad 2021. u odnosu na isti mjesec prethodne godine

nominalno je viša za 5,7%, a realno za 1,8%.

|

|

The

average monthly paid off net earnings per person in paid employment in

legal entities in the Republic of Croatia for October 2021 were nominally

higher by 5.7% and really by 1.8%, as compared to the same month last year.

|

|

|

|

|

|

Prosječna

mjesečna bruto plaća po zaposlenome u pravnim osobama Republike Hrvatske za

listopad 2021. u odnosu na isti mjesec prethodne godine nominalno je viša

za 4,4%, a realno za 0,6%.

|

|

The

average monthly gross earnings per person in paid employment in legal

entities in the Republic of Croatia for October 2021 were nominally higher

by 4.4% and really by 0.6%, as compared to the same month last year.

|

|

|

|

|

|

Za

razdoblje od siječnja do listopada 2021. prosječna mjesečna isplaćena neto

plaća po zaposlenome u pravnim osobama Republike Hrvatske iznosila je 7 093

kune, što je u odnosu na isto razdoblje 2020. nominalno više za 5,4%, a

realno za 3,3%.

|

|

In

the period from January to October 2021, the average monthly paid off net

earnings per person in paid employment in legal entities in the Republic of

Croatia amounted to 7 093 kuna, which represented a nominal increase

of 5.4% and a real one of 3.3%, as compared to the same period of 2020.

|

|

|

|

|

|

Za

razdoblje od siječnja do listopada 2021. prosječna mjesečna bruto plaća po

zaposlenome u pravnim osobama Republike Hrvatske iznosila je 9 544 kune,

što je u odnosu na isto razdoblje 2020. nominalno više za 4,0%, a realno za

2,0%.

|

|

In

the period from January to October 2021, the average monthly gross earnings

per person in paid employment in legal entities in the Republic of Croatia

amounted to 9 544 kuna, which represented a nominal increase of 4.0%

and a real one of 2.0%, as compared to the same period of 2020.

|

|

|

|

|

|

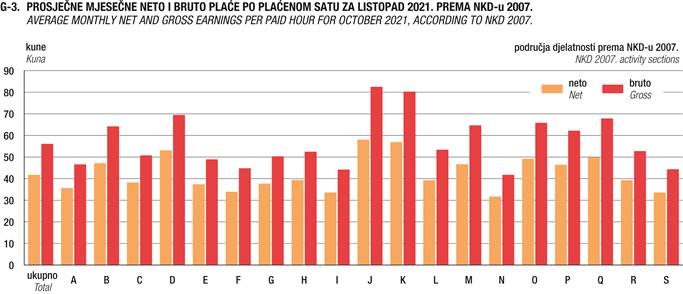

U

listopadu 2021. bilo je prosječno 167 plaćenih sati, što je u odnosu na

rujan 2021. niže za 4,0%. Najveći broj plaćenih sati bio je u Pomoćnim uslužnim

djelatnostima u rudarstvu i Djelatnosti zdravstvene zaštite (176), a

najmanji broj plaćenih sati bio je u Djelatnosti socijalne skrbi bez

smještaja (151).

|

|

In

October 2021, there were 167 paid hours on average, which means that they

decreased by 4.0%, as compared to September 2021. The greatest number of

paid hours was recorded in the Mining support service activities and Human

health activities (176) and the smallest one in Social work activities

without accommodation (151).

|

|

|

|

|

|

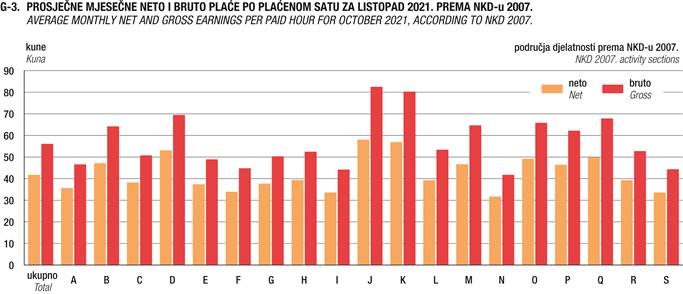

Prosječna

mjesečna isplaćena neto plaća po satu za listopad 2021. iznosila je 41,74

kune, što je u odnosu na rujan 2021. više za 4,5%, a u odnosu na isti

mjesec prethodne godine više za 10,2%.

|

|

The

average monthly paid off net earnings per hour for October 2021 amounted to

41.74 kuna, which was 4.5% higher than in September 2021. As compared to

the same month last year, they increased by 10.2%.

|

|

|

|

|

|

Prosječna

mjesečna bruto plaća po satu za listopad 2021. iznosila je 56,11 kuna, što

je u odnosu na rujan 2021. više za 4,6%, a u odnosu na isti mjesec

prethodne godine više za 9,0%.

|

|

The

average monthly gross earnings per hour for October 2021 amounted to 56.11

kuna, which was 4.6% higher than in September 2021. As compared to the same

month last year, they increased by 9.0%.

|

|

|

|

|

|

Medijalna

neto plaća za listopad 2021. iznosila je 6 039 kuna, dok je medijalna bruto

plaća iznosila 7 860 kuna.

|

|

Median

net earnings for October 2021 amounted to 6 039 kuna, while median gross

earnings amounted to 7 860 kuna.

|

|

|

|

|

|

Detaljne

podatke možete preuzeti na poveznici Statistika u

nizu.

|

|

Detailed

data can be downloaded on the link Statistics In

Line.

|

1. PROSJEČNA MJESEČNA NETO I BRUTO

PLAĆA ZA LISTOPAD 2021.

AVERAGE

MONTHLY NET AND GROSS EARNINGS FOR OCTOBER 2021

|

|

X. 2021.

|

I. – X.

2021.

|

Indeksi

Indices

|

|

|

X. 2021.

IX. 2021.

|

X. 2021.

X. 2020.

|

I. – X. 2021.

I. – X. 2020.

|

|

Neto plaća

Net

earnings

|

|

Prosječna

mjesečna isplaćena neto plaća po zaposlenome, kune

|

7

140

|

7

093

|

100,5

|

105,7

|

105,4

|

Average

monthly paid off net earnings per employee, kuna

|

|

Realna

neto plaća po zaposlenome

|

|

|

99,5

|

101,8

|

103,3

|

Real

net earnings per employee

|

|

Bruto plaća

Gross

earnings

|

|

Prosječna

mjesečna bruto plaća po zaposlenome, kune

|

9

597

|

9

544

|

100,5

|

104,4

|

104,0

|

Average

monthly gross earnings per employee, kuna

|

|

Realna

bruto plaća po zaposlenome

|

|

|

99,5

|

100,6

|

102,0

|

Real

gross earnings per employee

|

|

Neto plaća po satu

Net

earnings per hour

|

|

Prosječna

mjesečna isplaćena neto plaća po satu, kune

|

41,74

|

40,50

|

104,5

|

110,2

|

106,2

|

Average

paid off net earnings per hour, kuna

|

|

Realna

neto plaća po satu

|

|

|

103,5

|

106,2

|

104,1

|

Real

net earnings per hour

|

|

Bruto plaća po satu

Gross

earnings per hour

|

|

Prosječna

mjesečna bruto plaća po satu, kune

|

56,11

|

54,50

|

104,6

|

109,0

|

104,7

|

Average

monthly gross earnings per hour, kuna

|

|

Realna

bruto plaća po satu

|

|

|

103,6

|

105,0

|

102,6

|

Real

gross earnings per hour

|

2. DISTRIBUCIJA

NETO I BRUTO PLAĆA PREMA KVARTILIMA ZA LISTOPAD 2021.

DISTRIBUTION

OF NET AND GROSS EARNINGS, BY QUARTILES, FOR OCTOBER 2021

|

|

X.

2021.

|

|

|

neto plaće, kune

Net earnings, kuna

|

bruto plaće, kune

Gross earnings, kuna

|

|

|

|

|

|

|

Prvi

(donji) kvartil

|

4

604

|

5

823

|

First

(lower) quartile

|

|

Drugi

kvartil (medijan)

|

6

039

|

7

860

|

Second

quartile (median)

|

|

Treći

(gornji) kvartil

|

8

309

|

11

145

|

Third

(upper) quartile

|

|

Četvrti kvartil

|

z

|

z

|

Fourth

quartile

|

3. DISTRIBUCIJA

NETO I BRUTO PLAĆA PREMA DECILIMA ZA LISTOPAD 2021.

DISTRIBUTION

OF NET AND GROSS EARNINGS, BY DECILES, FOR OCTOBER 2021

|

|

X.

2021.

|

|

|

neto plaće, kune

Net earnings, kuna

|

bruto plaće, kune

Gross earnings, kuna

|

|

|

|

|

|

|

Prvi

decil

|

3

874

|

4

732

|

First

decile

|

|

Drugi

decil

|

4

361

|

5

411

|

Second

decile

|

|

Treći

decil

|

4

810

|

6

027

|

Third

decile

|

|

Četvrti

decil

|

5

370

|

6

843

|

Fourth

decile

|

|

Peti

decil (medijan)

|

6

039

|

7

860

|

Fifth

decile (median)

|

|

Šesti

decil

|

6

845

|

9

008

|

Sixth

decile

|

|

Sedmi

decil

|

7

785

|

10

410

|

Seventh

decile

|

|

Osmi

decil

|

8

937

|

12

047

|

Eighth

decile

|

|

Deveti

decil

|

11

108

|

15

488

|

Ninth

decile

|

|

Deseti decil

|

z

|

z

|

Tenth

decile

|

4. ISPLAĆENI

NEOPOREZIVI PRIMICI PREMA NKD-u 2007.1) U LISTOPADU 2021.

PAID

OFF NON-TAXABLE INCOMES, ACCORDING TO NKD 2007.1), OCTOBER 2021

|

|

X.

2021.

|

|

|

prosječni

neoporezivi primitak po broju primatelja, kune

Average

non-taxable income by number of receivers, kuna

|

prosječni neoporezivi primitak po broju

zaposlenih koji su primili plaću, kune

Average non-taxable income by number of

persons in employment who received earnings, kuna

|

|

|

|

|

|

|

|

|

Ukupno

|

659

|

6

|

Total

|

|

|

|

|

|

|

|

|

A

|

Poljoprivreda,

šumarstvo i ribarstvo

|

527

|

7

|

A

|

Agriculture,

forestry and fishing

|

|

B

|

Rudarstvo i

vađenje

|

584

|

4

|

B

|

Mining and

quarrying

|

|

C

|

Prerađivačka

industrija

|

501

|

6

|

C

|

Manufacturing

|

|

D

|

Opskrba

električnom energijom, plinom, parom

i klimatizacija

|

436

|

3

|

D

|

Electricity,

gas, steam and air conditioning

supply

|

|

E

|

Opskrba

vodom; uklanjanje otpadnih voda, gospodarenje otpadom te djelatnosti

sanacije okoliša

|

398

|

9

|

E

|

Water

supply; sewerage, waste management

and remediation activities

|

|

F

|

Građevinarstvo

|

708

|

10

|

F

|

Construction

|

|

G

|

Trgovina na

veliko i na malo;

popravak motornih vozila i motocikla

|

560

|

5

|

G

|

Wholesale

and retail trade;

repair of motor vehicles and motorcycles

|

|

H

|

Prijevoz i

skladištenje

|

1

270

|

12

|

H

|

Transportation

and storage

|

|

I

|

Djelatnosti

pružanja smještaja te pripreme

i usluživanja hrane

|

1

117

|

7

|

I

|

Accommodation

and food service

activities

|

|

J

|

Informacije

i komunikacije

|

549

|

2

|

J

|

Information

and communication

|

|

K

|

Financijske

djelatnosti i djelatnosti osiguranja

|

712

|

1

|

K

|

Financial

and insurance activities

|

|

L

|

Poslovanje

nekretninama

|

592

|

3

|

L

|

Real estate

activities

|

|

M

|

Stručne,

znanstvene i tehničke djelatnosti

|

525

|

8

|

M

|

Professional,

scientific and technical activities

|

|

N

|

Administrativne

i pomoćne uslužne djelatnosti

|

543

|

19

|

N

|

Administrative

and support service activities

|

|

O

|

Javna

uprava i obrana;

obvezno socijalno osiguranje

|

640

|

2

|

O

|

Public

administration and defence;

compulsory social security

|

|

P

|

Obrazovanje

|

708

|

1

|

P

|

Education

|

|

Q

|

Djelatnosti

zdravstvene zaštite i socijalne skrbi

|

1

372

|

10

|

Q

|

Human

health and social work activities

|

|

R

|

Umjetnost,

zabava i rekreacija

|

470

|

2

|

R

|

Arts,

entertainment and recreation

|

|

S

|

Ostale

uslužne djelatnosti

|

605

|

4

|

S

|

Other

service activities

|

1) Područja

djelatnosti T (Djelatnosti kućanstava kao poslodavaca; djelatnosti kućanstava

koja proizvode različitu robu i obavljaju različite usluge za vlastite

potrebe) i U (Djelatnosti izvanteritorijalnih organizacija i tijela) te

njihovi odjeljci nisu iskazani u ovom Priopćenju jer nisu obuhvaćeni

istraživanjem.

1) Activity sections T (Activities of

households as employers; undifferentiated goods – and services – producing

activities of households for own use) and U (Activities of extraterritorial

organisations and bodies) as well as their divisions are not presented in

this First Release since they were not covered by the survey.

|

Područja djelatnosti prema NKD-u 2007.

|

|

NKD 2007. activity sections

|

|

|

|

|

|

|

|

A

|

Poljoprivreda,

šumarstvo i ribarstvo

|

|

A

|

Agriculture, forestry and fishing

|

|

B

|

Rudarstvo

i vađenje

|

|

B

|

Mining and quarrying

|

|

C

|

Prerađivačka

industrija

|

|

C

|

Manufacturing

|

|

D

|

Opskrba

električnom energijom, plinom, parom i klimatizacija

|

|

D

|

Electricity, gas, steam and air

conditioning supply

|

|

E

|

Opskrba

vodom; uklanjanje otpadnih voda, gospodarenje

otpadom te djelatnosti sanacije okoliša

|

|

E

|

Water supply; sewerage, waste management

and remediation

activities

|

|

F

|

Građevinarstvo

|

|

F

|

Construction

|

|

G

|

Trgovina

na veliko i na malo; popravak motornih vozila i motocikla

|

|

G

|

Wholesale and retail trade; repair of motor vehicles

and motorcycles

|

|

H

|

Prijevoz

i skladištenje

|

|

H

|

Transportation and storage

|

|

I

|

Djelatnosti

pružanja smještaja te pripreme i usluživanja hrane

|

|

I

|

Accommodation and food service activities

|

|

J

|

Informacije

i komunikacije

|

|

J

|

Information and communication

|

|

K

|

Financijske

djelatnosti i djelatnosti osiguranja

|

|

K

|

Financial and insurance activities

|

|

L

|

Poslovanje

nekretninama

|

|

L

|

Real estate activities

|

|

M

|

Stručne,

znanstvene i tehničke djelatnosti

|

|

M

|

Professional, scientific and technical activities

|

|

N

|

Administrativne

i pomoćne uslužne djelatnosti

|

|

N

|

Administrative and support service activities

|

|

O

|

Javna

uprava i obrana; obvezno socijalno osiguranje

|

|

O

|

Public administration and defence; compulsory social

security

|

|

P

|

Obrazovanje

|

|

P

|

Education

|

|

Q

|

Djelatnosti

zdravstvene zaštite i socijalne skrbi

|

|

Q

|

Human health and social work activities

|

|

R

|

Umjetnost,

zabava i rekreacija

|

|

R

|

Arts, entertainment and recreation

|

|

S

|

Ostale

uslužne djelatnosti

|

|

S

|

Other service activities

|

|

METODOLOŠKA

OBJAŠNJENJA

|

|

NOTES

ON METHODOLOGY

|

|

|

|

|

|

|

|

|

|

Izvori

podataka

|

|

Data

sources

|

|

|

|

|

|

Podaci

o mjesečnim neto i bruto plaćama te broju sati za koje su zaposlene osobe

primile plaću dobiveni su obradom podataka iz Izvješća o primicima, porezu

na dohodak i prirezu te doprinosima za obvezna osiguranja (obrazac JOPPD),

koje se primjenjuje

od 1. siječnja 2014.

|

|

Data

on monthly net and gross earnings as well as data on paid

hours were gathered by processing data from the Report on Income, Income

Tax and Surtax as well as Contributions for Mandatory Insurances (JOPPD

form), in effect since 1 January 2014.

|

|

|

|

|

|

Obveznici

dostavljanja obrasca JOPPD jesu isplatitelji svih vrsta dohodaka za koje je

propisima o porezu na dohodak propisana obveza obračunavanja i plaćanja

poreza po odbitku.

|

|

All

persons or entities that are the payers of income for which the income tax

regulations prescribe the obligation of accounting and paying deduction tax

are under the obligation to submit the JOPPD form.

|

|

|

|

|

|

|

|

|

|

Obuhvat

i usporedivost

|

|

Coverage

and comparability

|

|

|

|

|

|

Obuhvaćeni

su zaposleni u pravnim osobama svih oblika vlasništva, tijelima državne

vlasti i tijelima jedinica lokalne i područne (regionalne) samouprave na

području Republike Hrvatske.

|

|

Data

comprise persons in employment in legal entities of all types of ownership,

government bodies, and bodies of local and regional self-government units,

on the territory of the Republic of Croatia.

|

|

|

|

|

|

Nisu

obuhvaćeni zaposleni u obrtu i slobodnim profesijama i zaposleni

osiguranici poljoprivrednici te unutar podataka o prosječnim mjesečnim

plaćama nedostaju podaci o njihovim isplatama.

|

|

Persons

employed in crafts and trades and free lances and employed insured persons

– private farmers are not covered, so data on their pays are not included

in the data on average earnings.

|

|

|

|

|

|

Podaci

o mjesečnim neto i bruto plaćama zaposlenih u pravnim osobama obuhvaćaju

neto i bruto plaće zaposlenih koji imaju zasnovan radni odnos bez obzira na

vrstu radnog odnosa i duljinu radnog vremena.

|

|

Data

on monthly net and gross earnings of persons employed in legal entities

include net and gross earnings of persons in permanent employment,

irrespective of the kind of employment and number of working-hours.

|

|

|

|

|

|

Zaposleni

koji su primili plaću u nepunome radnom vremenu preračunani su na

ekvivalent punoga radnog vremena.

|

|

Persons

in part-time employment who received earnings are expressed in full-time

equivalent.

|

|

|

|

|

|

Podaci

o mjesečnoj neto i bruto plaći iskazuju se prema načelu obavljenih isplata

u tekućemu za prethodni mjesec, što odgovara dinamici isplata u najvećem

broju pravnih osoba te se i prosjek plaće odnosi na mjesec za koji je

isplata primljena, što ne vrijedi za

isplaćene neoporezive primitke.

|

|

Data

on monthly net and gross earnings are presented according to realised

pay-offs in the current for the previous month, which is in line with the

pay-off dynamics in most legal entities, so the average earnings refer to

the month for which the pay-off has been received. It does

not apply to paid-off non-taxable incomes.

|

|

|

|

|

Neoporezivi primici koje je zaposlenik primio

iskazani su u tablici 4.

|

|

Non-taxable

incomes received by person in employment are presented in table 4.

|

|

|

|

|

Obuhvaćeni

su sljedeći neoporezivi primici, prema šiframa obrasca JOPPD:

|

|

The

following non-taxable incomes are covered, according to codes on the JOPPD

form:

|

|

|

|

|

šifra

21 −

|

dar djetetu do 15

godina starosti i potpore za novorođenče, do propisanog iznosa

|

|

Code 21

–

|

gift

for a child younger than 15 and benefit for a newborn, up to a prescribed

amount

|

šifra

22 –

|

prigodne nagrade,

do propisanog iznosa (božićnica, naknada za godišnji odmor i sl.)

|

|

Code 22

–

|

occasional

bonuses (Christmas bonus, annual leave bonus, etc.), up to a prescribed

amount

|

šifra

24 –

|

pomorski dodatak,

do propisanog iznosa

|

|

Code 24

–

|

supplements

for seafarers, up to a prescribed amount

|

šifra

25 –

|

naknade za

odvojeni život od obitelji, do propisanog iznosa

|

|

Code 25

–

|

compensation

for living separately from family, up to a prescribed amount

|

šifra

26 –

|

otpremnine,

do propisanog iznosa

|

|

Code 26

–

|

severance,

up to a prescribed amount

|

šifra

60 –

|

nagrade

radnicima za navršene godine staža, do propisanog iznosa

|

|

Code 60

–

|

jubilee

payments to persons in employment depending on years of service, up to a

prescribed amount

|

šifra

61 –

|

prigodne

nagrade, do propisanog iznosa (božićnica, naknada za godišnji odmor i sl.)

za prethodna porezna razdoblja (naknadne isplate)

|

|

Code 61

–

|

occasional

bonuses (Christmas bonus, annual leave bonus, etc.) for previous taxation

periods (subsequent payments), up to a prescribed amount

|

šifra

62 –

|

trošak

prehrane i smještaja sezonskih radnika iz članka 7. stavka 35. Pravilnika o

porezu na dohodak

|

|

Code 62

–

|

expenses

for food and accommodation of seasonal workers, according to Article 7,

Item 35, of the Income Tax Ordinance

|

šifra

63 –

|

novčane

nagrade za radne rezultate i drugi oblici dodatnog nagrađivanja radnika

(dodatna plaća, dodatak uz mjesečnu plaću i sl.)

|

|

Code 63

–

|

pecuniary

awards for performance results and other types of additional awarding of

persons in employment (supplemental earnings, supplements to monthly

earnings, etc.)

|

šifra

64 –

|

troškovi

smještaja i prehrane osoba koje obavljaju povremene sezonske poslove u

poljoprivredi iz članka 6. stavka 10. Pravilnika o porezu na dohodak

|

|

Code 64

–

|

expenses

for accommodation and food of persons engaged in occasional seasonal

agricultural works, according to Article 6, Item 10, of the Income Tax

Ordinance

|

šifra

65 –

|

novčane

paušalne naknade za podmirivanje troškova prehrane radnika, do propisanog

iznosa

|

|

Code 65

–

|

pecuniary

lump-sum reimbursements for covering food costs of persons in employment,

up to a prescribed amount

|

|

|

|

|

|

|

šifra

66 –

|

troškovi

prehrane radnika nastali za vrijeme radnog odnosa kod poslodavca na temelju

vjerodostojne dokumentacije, do propisanog iznosa

|

|

Code 66

–

|

food

expanses for persons in employment emerged during employment with the

employer based on authentic documentation, up to a prescribed amount

|

šifra

67 –

|

troškovi

smještaja radnika nastali za vrijeme radnog odnosa kod poslodavca na

temelju vjerodostojne dokumentacije koji se podmiruju bezgotovinskim putem

|

|

Code 67

–

|

accommodation

expenses for persons in employment emerged during employment with the

employer based on authentic documentation, paid through cashless

transaction

|

šifra

68 –

|

troškovi

smještaja radnika nastali za vrijeme radnog odnosa kod poslodavca na

temelju vjerodostojne dokumentacije koji se podmiruju na račun radnika

|

|

Code 68

–

|

accommodation

expenses for persons in employment emerged during employment with the

employer based on authentic documentation, transmitted to worker’s account

|

šifra

69 –

|

naknade

za podmirivanje troškova ugostiteljskih, turističkih i drugih usluga

namijenjenih odmoru radnika prema propisima ministarstva nadležnog za

turizam

|

|

Code 69

–

|

reimbursements

for expanses of hospitality, tourist and other services rendered during

workers’ vacation, pursuant to regulations determined by the ministry in

charge for tourism

|

šifra

70 –

|

naknade

za troškove redovite skrbi djece radnika u ustanovama predškolskog odgoja

te drugim pravnim ili fizičkim osobama (vrtići i sl.)

|

|

Code 70

–

|

reimbursements

for expanses of regular care for workers’ children in institutions of

pre-school education as well as in other legal entities or natural persons

(kindergartens etc.)

|

šifra

71 –

|

premije

dopunskoga i dodatnoga zdravstvenog osiguranja – u primjeni od 2020.

|

|

Code 71

–

|

premiums

of supplemental and additional health inisurance – in effect since 2020.

|

|

|

|

|

|

Od

siječnja 2016. podaci nisu usporedivi s prethodno objavljenim mjesečnim

podacima.

|

|

Data

from January 2016 and onwards are not comparable to previously published

monthly data.

|

|

|

|

|

|

|

|

|

|

Definicije

|

|

Definitions

|

|

|

|

|

|

Prosječna

mjesečna isplaćena neto plaća obuhvaća plaće zaposlenih za

obavljene poslove prema osnovi radnog odnosa i naknade za godišnji odmor,

plaćeni dopust, blagdane i neradne dane određene zakonom, bolovanja do 42

dana, odsutnost za vrijeme stručnog obrazovanja, zastoje na poslu bez

krivnje zaposlenog i primitke prema osnovi naknada, potpora i nagrada u

iznosima na koje se plaćaju doprinosi, porezi i prirezi.

|

|

Average

monthly paid off net earnings comprise income of

a person in employment earned for work done during regular working hours as

well as annual leave, paid leave, public holidays and day-offs as

prescribed by law, sickness leave up to 42 days, absence for continuing

professional education, during lay-off and job stop caused against person’s

will and of no fault of his own and net pays on the basis of compensations,

allowances and rewards in sums which are subjects to contributions, taxes

and surtaxes.

|

|

|

|

|

|

Prosječna

mjesečna bruto plaća obuhvaća sve vrste neto isplata prema

osnovi radnog odnosa i sljedeća zakonom propisana obvezatna izdvajanja:

doprinose za mirovinsko osiguranje, porez na dohodak i prirez porezu na

dohodak.

|

|

Average

monthly gross earnings include all kinds of net pays on

the basis of employment and the following mandatory allocations: pension

insurance contributions, income tax and surtax on income tax.

|

|

|

|

|

|

Broj

plaćenih sati jest broj sati za koje su zaposlene osobe primile

plaću. Plaćeni sati uključuju izvršene sate rada (sati izvršeni u

redovitome radnom vremenu i prekovremeni sati) i neizvršene sate rada

(godišnji odmor, praznici, bolovanje kraće od 42 dana i drugi plaćeni, a

neizvršeni sati). Plaćeni sati ne uključuju neizvršene sate rada plaćene

izvan pravne osobe (sati bolovanja u trajanju duljem od 42 dana, sati

rodiljnog dopusta, sati skraćenoga radnog vremena roditelja i sl.).

|

|

Number

of paid hours is a number of hours for which persons

in employment were paid. They include hours actually worked (hours done

during regular working time and overtime hours) and hours not actually

worked (annual leave, holidays, sick leave lasting less than 42 days and

other paid hours not actually done). Paid hours do not include working

hours not actually worked which are paid outside a legal entity (sick leave

hours lasting over 42 days, maternity leave hours, hours of shorter working

time done by parents, etc.).

|

|

|

|

|

|

Prosječna

mjesečna neto i bruto plaća po zaposlenome izračunava se

dijeljenjem ukupnih isplata brojem zaposlenih preračunanih na ekvivalent

punoga radnoga vremena.

|

|

Average

monthly net and gross earnings per person in employment are

calculated by dividing the total of pay-offs with the number of persons in

employment expressed in full-time equivalent.

|

|

|

|

|

|

Prosječna

mjesečna neto i bruto plaća po plaćenom satu izračunava se

dijeljenjem ukupnih isplata ukupnim brojem plaćenih sati.

|

|

Average monthly net and gross

earnings per paid hour are calculated by dividing the

total of pay-offs with the total number of paid hours.

|

|

|

|

|

|

Nominalni

indeksi neto i bruto plaća izračunavaju se iz podataka o

prosječnim mjesečnim iznosima neto i bruto plaća za odgovarajuće mjesece i

godine.

|

|

Indices

of nominal net and gross earnings are calculated

from the data on average monthly net and gross earnings for the respective

months and year.

|

|

|

|

|

|

Realni

indeksi

neto i bruto plaća izračunavaju se dijeljenjem nominalnih indeksa neto i

bruto plaća indeksom potrošačkih cijena za odgovarajuće mjesece i godine.

|

|

Real

indices of net and gross earnings are calculated

by dividing index of nominal net and gross earnings with a consumer price

index for the respective month and year.

|

|

|

|

|

|

Medijalna

mjesečna neto i bruto plaća izračunava se određivanjem sredine

nakon rangiranja plaća zaposlenih, od najniže do najviše, te pokazuje da

50% zaposlenih prima plaću u iznosu jednakom ili manjem od tog iznosa

(medijana), a 50% zaposlenih prima jednaku ili veću od tog iznosa

(medijana).

|

|

Median

monthly net and gross earnings are calculated by

determining a mean after earnings of persons in employment have been rank-ordered

from the lowest to the highest one and shows that 50% of persons in

employment get earnings that are equal to or lower than that amount

(median) and another 50% get earnings that are equal to or higher than that

amount (median).

|

|

|

|

|

|

Kvartilne

mjesečne neto i bruto plaće izračunavaju se podjelom plaća

zaposlenih na četiri jednaka dijela nakon rangiranja od najniže do najviše,

a zatim odabirom iznosa plaće ispod kojeg se nalazi 25%, 50%, 75% i 100%

plaća zaposlenih. Mogu se podijeliti na prvi (donji) kvartil, drugi kvartil

(medijan), treći (gornji) kvartil i četvrti kvartil.

|

|

Quartile

monthly net and gross earnings are calculated by

dividing the earnings of persons in employment into four equal parts after

they have been rank-ordered from the lowest to the highest one. Then the

amount is selected below which 25%, 50%, 75% and 100% of the earnings of

persons in employment are placed. They can be divided to first (lower)

quartile, second quartile (median), third (upper) quartile and fourth

quartile.

|

|

|

|

|

|

Prvi

(donji) kvartil pokazuje da 25% zaposlenih prima plaću u

iznosu jednakom ili manjem od prvoga kvartila, a 75% zaposlenih prima plaću

jednaku ili veću od prvoga kvartila.

|

|

The

first (lower) quartile indicates that 25% of persons in

employment get earnings that are equal to or lower than the first quartile,

while 75% of persons in employment get earnings that are equal to or higher

than the first quartile.

|

|

|

|

|

|

Treći

(gornji) kvartil pokazuje da 75% zaposlenih prima plaću u

iznosu jednakom ili manjem od trećega kvartila, a 25% zaposlenih prima

plaću jednaku ili veću od trećega kvartila.

|

|

The

third (upper) quartile indicates that 75% of persons in

employment get earnings that are equal to or lower than the third quartile,

while 25% of persons in employment get earnings that are equal to or higher

than the third quartile.

|

|

|

|

|

|

Decilne

mjesečne neto i bruto plaće izračunavaju se podjelom plaća

zaposlenih na deset jednakih dijelova nakon rangiranja od najniže do

najviše, a zatim odabirom iznosa plaće ispod kojeg se nalazi 10%, 20%, 30%,

40%, 50%, 60%, 70%, 80%, 90% i 100% plaća zaposlenih.

|

|

Decile

monthly net and gross earnings are calculated by

dividing earnings of persons in employment into ten equal parts after they

have been rank-ordered from the lowest to the highest one. Then the amount

is selected below which 10%, 20%, 30%, 40%, 50%, 60%, 70%, 80%, 90% and

100% of earnings of persons in employment are placed.

|

|

|

|

|

|

U

prvom decilu nalaze se zaposleni koji imaju najniže mjesečne plaće i

pokazuje da 10% zaposlenih prima plaću u iznosu jednakom ili manjem

od prvog decila, a 90% zaposlenih prima plaću jednaku ili veću od

tog iznosa. U drugom decilu nalaze se zaposleni koji primaju plaću veću od

onih koji se nalaze u prvom decilu i manju od onih koji se nalaze u trećem

decilu itd.

|

|

The

first decile includes persons in employment with the

lowest monthly earnings and indicates that 10% of persons in employment get

earnings that are equal to or lower than the first decile, while 90% of

persons in employment get earnings that are equal to or higher than that

amount. The second decile includes persons in employment who get earnings

that are higher than those included in the first decile and lower than

those included in the third decile, etc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kratice

|

|

Abbreviations

|

|

|

|

|

|

NKD

2007.

|

Nacionalna

klasifikacija djelatnosti, verzija 2007.

|

|

NKD

2007.

|

National

Classification of Activities, 2007 version

|

|

z

|

podatak

zbog povjerljivosti nije objavljen

|

|

z

|

data

are not published for confidentiality reasons

|

|

|

|

|

|

|

Objavljuje Državni zavod za

statistiku Republike Hrvatske, Zagreb, Ilica 3, p. p. 80.

Published by the Croatian Bureau of

Statistics, Zagreb, Ilica 3, P. O. B. 80

Telefon/ Phone: +385

(0) 1 4806-111, telefaks/ Fax: +385 (0) 1 4817-666

Novinarski upiti/ Press

corner: press@dzs.hr

Odgovorne osobe:

Persons responsible:

Dubravka Rogić Hadžalić, načelnica

Sektora demografskih i društvenih statistika

Dubravka Rogić Hadžalić, Director of

Demographic and Social Statistics Directorate

Lidija Brković, glavna ravnateljica

Lidija Brković, Director General

Priredile: Katarina Litva, Zdenka

Mandarić i Snježana Varga

Prepared by: Katarina Litva, Zdenka

Mandarić and Snježana Varga

|

|

MOLIMO KORISNIKE

DA PRI KORIŠTENJU PODATAKA NAVEDU IZVOR.

USERS ARE KINDLY

REQUESTED TO STATE THE SOURCE.

|

|

Služba za odnose s korisnicima i

zaštitu podataka

Customer Relations and Data

Protection Department

|

Informacije i korisnički zahtjevi

Information and user requests

|

|

Pretplata publikacija

Subscription

|

|

|

|

|

|

Telefon/ Phone: +385 (0) 1 4806-138, 4806-154

Elektronička pošta/ E-mail: stat.info@dzs.hr

Telefaks/ Fax: +385 (0) 1 4806-148

|

|

Telefon/ Phone: +385 (0) 1 4806-115

Elektronička pošta/ E-mail: prodaja@dzs.hr

Telefaks/ Fax: +385 (0) 1 4806-148

|

|